In the newer versions, you’re able to log into your bank, credit cards, etc., and automatically import data. In the past, you had to import all of your financial information into YNAB manually. The newest version of the YNAB app has a clean interface – something Mint users will appreciate. It also emphasizes financial education as it looks to make its user into savvy budgeters. No, really – it does budgeting, and does it well – and not much else.

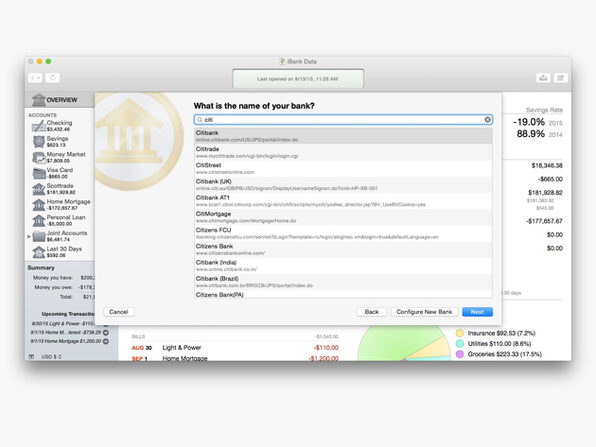

#Banktivity for android software

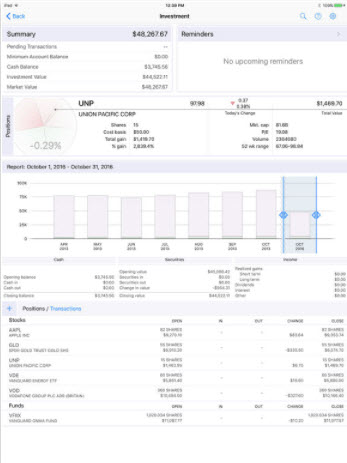

Generally speaking, it’s more focused on tracking your net worth and investments, but it also has a budgeting section that offers the same income and expense tracking as Mint. Personal Capital has been around since 2009, but it has gained quite a bit of popularity in the past few years. Here are the 11 best Mint alternatives to help you manage your finances more effectively: In This Article 11 Best Mint Alternatives for 2022 Though it does an excellent job of helping people with their budgets, there are still several great alternatives to Mint worth checking out. It lets you see all of your accounts in one place, stay on top of your bills, create budgets, and access your credit score.

Mint is certainly a helpful money management tool. That’s the problem set out to solve when it was first released back in 2006. If you have numerous financial accounts (who doesn’t these days?), managing them all can get overwhelming.

0 kommentar(er)

0 kommentar(er)